Generally, when someone passes away due to the negligence of another, there are two types of claims that may be brought under Pennsylvania law: Wrongful Death and Survival Actions.

These actions are governed by the Pennsylvania Wrongful Death Act. This article will explain the key differences of each action as well as things to keep in mind if you are considering filing these types of claims.

What Is a Wrongful Death Action?

Wrongful Death Actions are governed by 42 Pa.C.S.A. Section 8301. The statute provides that an action may be brought to recover damages for the death of an individual caused by the wrongful act or negligence of another so long as no claims were obtained by the injured individual during his or her lifetime. Any prior actions for the same injuries will be consolidated with the wrongful death claim so that there is not a duplicative recovery.

For example, if a person initiates a lawsuit for injuries they sustained as a result of negligence and then later dies from those injuries before the lawsuit is concluded, the actions will be consolidated. Wrongful death actions may be filed even if there has already been a criminal case filed based on the circumstances of the death.

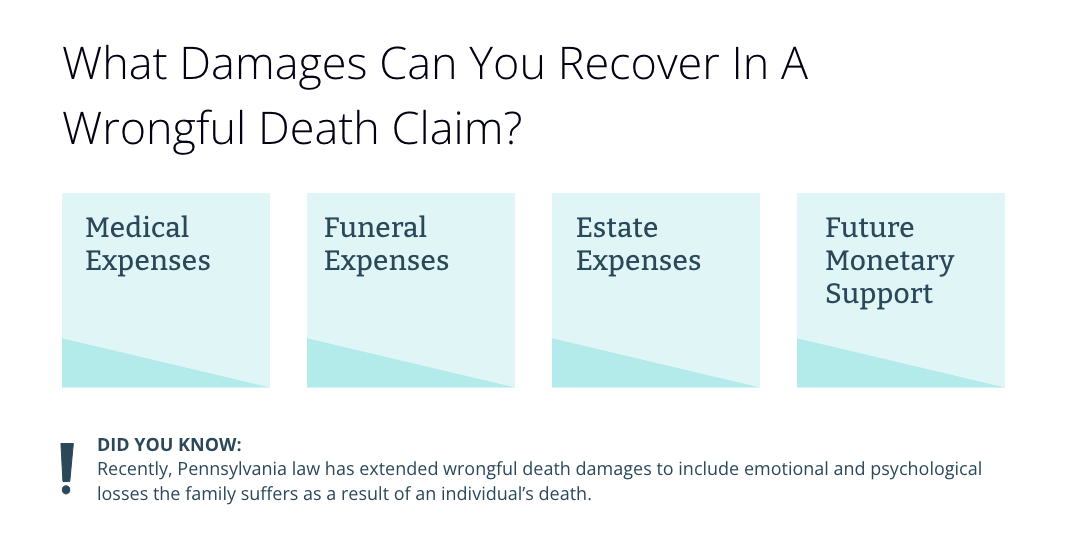

Damages Recoverable in Wrongful Death Claims

The types of damages that are recoverable under a wrongful death claim include economic loss to the decedent’s family as well as the loss of services, society, and comfort that the decedent would have provided or contributed had he or she lived.

More recently, Pennsylvania case law has extended wrongful death damages to also include the emotional and psychological loss that a family suffers as a result of the individual’s death. Specifically, in Rettger v. UPMC Shadyside, 991 A.2d 915 (Pa.Super. 2010), the Superior Court of Pennsylvania held that the term “services” was extended to mean the “profound emotional and psychological loss suffered” upon the death of the individual.

This can be particularly important in the case of a parent bringing a wrongful death action on behalf of their deceased minor child where the loss of compensable services may be minuscule.

Who Can Be a Wrongful Death Beneficiary?

Wrongful death proceeds are paid directly to the beneficiaries and are not subject to taxes or the decedent’s estate creditors.

However, many people do not realize that the only people who can qualify as beneficiaries under a wrongful death claim are spouses, children, and parents of the decedent (provided they can show a pecuniary loss). This means that brothers, sisters, grandparents, and in most cases, long-term boyfriends or girlfriends cannot be wrongful death beneficiaries.

This is true regardless of how dependent these people may be on the decedent at the time of death. If there are no qualifying wrongful death beneficiaries as per the statute, then a wrongful death claim cannot be brought on behalf of the deceased individual. For example, if an individual dies and has no surviving spouse, children, or parents, then a wrongful death claim may not be brought in Pennsylvania.

Pennsylvania Intestacy Laws

The allocation of the damage proceeds recovered on behalf of the wrongful death beneficiaries are determined by Pennsylvania intestacy law. Generally, the intestacy law provides as follows:

- If there is a surviving spouse, then the first $30,000 of the recovery goes to the spouse and the remainder is split evenly between the spouse and the children.

- If there are no children, then the remainder is split evenly between the spouse and the surviving parents.

- If there is no surviving spouse, then the proceeds are split evenly between the surviving children and if no children, then to the surviving parents.

What Is a Survival Action Claim?

Regardless of whether a wrongful death action may be brought or not, a survival action may still be a valid claim brought by the personal representative of the decedent’s estate. A survival action, governed by 42 Pa.C.S.A. Section 8301, is simply when the decedent’s estate stands in the shoes of the person who has passed away.

The personal representative for the estate is able to bring the same claims that the decedent could have brought if they were still alive. Damages recoverable under a survival action may include things like the decedent’s pain and suffering, medical bills, and past and future wage loss.

How Is Compensation Paid Out in a Survival Action?

In the case of a survival action, the decedent’s estate is the beneficiary of any damages recovered. Accordingly, any money recovered under this action would pass through the estate through the probate process.

If there is no will, the money would pass through intestacy law as explained in general terms above. On the other hand, if the decedent died with a will, the money would pass through the estate as designated through the terms of the will. Unlike wrongful death, survival action proceeds are subject to taxes and can also be used to satisfy any outstanding claims of estate creditors.

Questions about Wrongful Death or Survival Actions? Contact Atlee Hall

When a claim involving both wrongful death and survival action resolves short of a verdict reached at trial, court approval is typically necessary to approve the allocation of damages between the two actions. This helps to protect the interests of both the beneficiaries as well as the state of Pennsylvania in making sure that proper taxes are paid when a claim is resolved.

It is best recommended to hire a qualified lawyer in Lancaster, PA to help handle any wrongful death or survival actions cases. Contact our firm today at (717) 393-9596 to schedule an initial consultation.